Too Many High End Public Courses - a day at the golf show

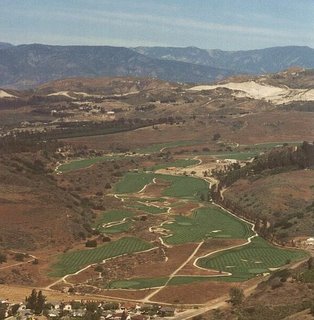

Copper Creek's success spawned a series of $150 green fee courses, but many overlooked its key ingredient, location.

I went down to the golf show at the Convention Centre in Toronto yesterday. The golf show is about selling equipment and promoting places to play. As an architect, I do not go down there to promote myself or look for work; it’s more of a chance to see good friends and hangout with a lot of people from the golf industry.

Three interesting things came up during the day.

The NGCOA is promoting Take a Kid to the Course Week from July 3rd to July 9th. Any paying adult can take a child, under the age of 16 to one of 500 participating golf courses, and the child can play for free. This also includes clinics, rentals, tournaments and a prize draw. I commend the National Golf Course Owners Association of Canada for doing something to promote the game. I, for one, will be participating to support the program.

The second thing that came up in conversation was the possibility of having the Canadian government recognize Stanley Thompson as a person of national significance. This would have a far reaching implication on preservation of his work.

Finally, the talk of the show was the number of high end courses around the greater Toronto area. There are definitely too many already, and more coming into the market. Many new ones are built in markets where the local population will not support the green fee. All the Niagara courses are competing for the “assumed” Casino traffic (and the Buffalo region which is in a horrible economic slump), yet the spin off golfers from the Casinos were not there to support the Legends complex in the first place. I’m not sure where they will attract the players from, since all are built on flat sites which traditionally don’t attract players from outside the community. A Hamilton area course wants a 150 dollar green fee from a community that is quite blue collar and a region that offers a lot of good options at less than half the price. If the parking lot is often nearly empty, that is not a good business model. Even more perplexing is a course in Bellville charging a very high green fee when you have courses like Timber Ridge near by offering excellent value. People will drive for a better value. I personally can not figure where these courses got their financial model from, beyond copying the existing high end courses of Toronto. How could they possibly assume they could export it to other smaller communities, with out some adjustment for local economics?

There is a market, and there is a price point that will work in each community. You must start with that price point and figure out what you can build first. If you can afford the land, the build and the amenities, you will have a business that will work. If the course is exceptional, then you will draw from further away and get a better return. But if the course was expensive to build, and is considered only average, you will have trouble carrying your costs. Even people with exceptionally deep pockets will only pay for so long before they have to walk away. They didn’t get their money in the first place from this style of investing.

It will be interesting to watch the year unfold. I was around for the last similar cycle and this high end public course build out matches the private course bloom of the late 80’s. Clublink was born from that period, will Clublink or a new entity be an accumulator once again. The smart money went to the sidelines a few years ago saying that it could just acquire these courses with a little patience. It will be interesting to see if that is the case.